ExpertOption Signals

ExpertOption Signals

What is a signal? Signals are typically a sign of an impending event. In the case of trading with ExpertOption a signal will indicate a forthcoming price movement. They can be used to compliment the usual tools of analysis such as; Indicators, charts, levels and trends. In essence signals are a series of technical indicators configured to reveal a certain set of results, they can be used independently to gather information before opening a trade, or more commonly used in tandem with additional strategies to confirm the accuracy of the signal, which dramatically increases the likelihood of earning a profit.

Support and Resistance Levels

During technical analysis of the markets, support and resistance are predetermined levels of the price, at which it is believed the price will tend to halt and reverse. The levels are indicated by numerous attempts to reach the predetermined price without actually breaking through, hence the terms support and resistance.

The strategy most frequently associated with their use is referred to as ‘Breakout Trading’. That is, when the price moves above a resistance level or below a support level, traders will know they have to act accordingly, this is usually a sign of high volatility. However, such market behaviour is not easily predictable, often the price can just as easily break the levels of support and resistance, only to immediately return in the direction it came. Knowing whether or not to open a trade during a breakout is tough, although the use of signals can help make the decision easier.

Here is an example of this use:

In this example we notice that the price has broken through the level of resistance. If we are to implement our strategy, this would be a strong signal to buy, otherwise known as a ‘Call Option’ However, if we take a closer look at the trend bar on the right of the platform, we can see GBP/USD is showing an average downward direction. This implies, that at this moment the risk of a Call option is high. In the below example, we’re able to see the trend signal was correct, as the price returned back below the resistance level, having made a call options here would have led to a loss.

Having narrowly avoided a loss, the support level was broken and a strong signal to sell or a ‘Put Option’ was highlighted.

As depicted in the above example, there was a significant movement below the support level, with a strong downward signal. Indicating that now would be the most profitable moment to open a deal. Below we can see the results of this deal.

Clearly the use of signals assisted with the success of this particular deal.

Here is another example of the successful implementation of signals. This time, we expect to see a breakout and a positive ‘Call Option’

Indicators plus signals

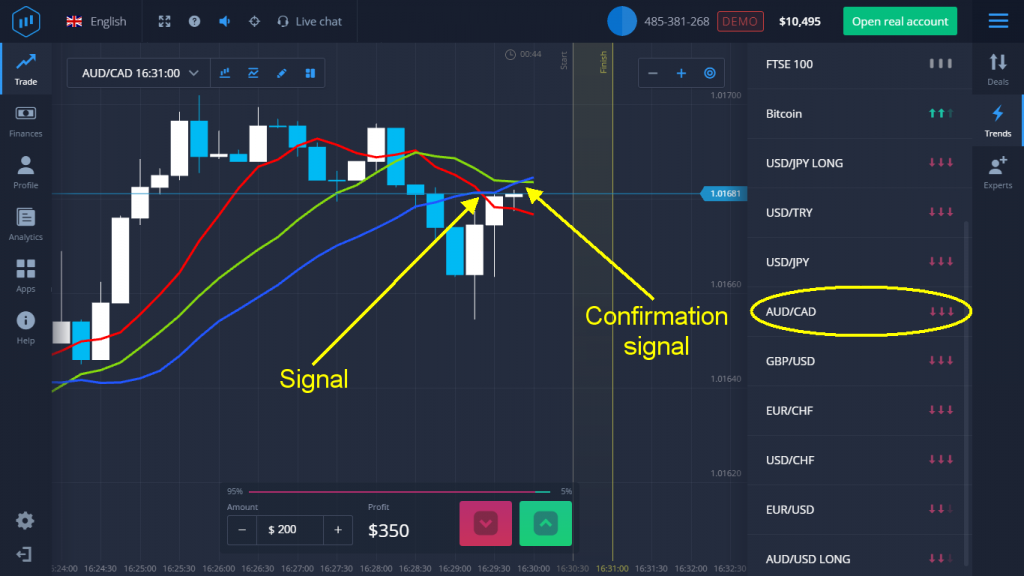

Most traders would not dream of limiting themselves by only using one tool of analysis, the more experienced traders amongst us will also be heavily reliant upon the use of indicators. To begin we will analyse the example of a strategy using three moving averages for different time periods.

ExpertOption Signal Summary

What can we determine from the above examples? First and foremost, ExpertOption signals are most effective as a supplement to a main strategy. The effectiveness is evidence, particularly numerically as signals undoubtedly help to increase the number of profitable trades. We’ve provided just a brief example using some strategies in combination with ExpertOption signals — for further details we suggest studying all of the educational materials and tutorial videos, before practicing them on the Free $10,000 Demo.

Leave a Reply

* Your email address will not be published. Required fields are marked